The Impact of Interest Rates on Capital Costs: What Every Business Should Know

Understanding the Basics: What Are Interest Rates and Capital Costs?

When it comes to running or growing a business, understanding the financial landscape is crucial. Two important concepts in this landscape are interest rates and capital costs. Interest rates represent the cost of borrowing money, typically expressed as a percentage of the loan amount, which borrowers must pay to lenders over time. Capital costs, on the other hand, refer to the total expenses a company incurs to acquire and maintain its physical assets, such as buildings, machinery, and equipment, or to raise funds for investment.

Interest rates directly influence capital costs because when a company borrows money, the cost of servicing that debt depends on these rates. If interest rates rise, the amount that must be paid over the life of a loan increases, driving up the overall capital costs. Conversely, lower interest rates can make borrowing cheaper, reducing capital expenses and potentially encouraging businesses to invest more.

How Do Interest Rates Affect Business Investment Decisions?

Interest rates play a pivotal role in shaping business decisions related to investment. Imagine a company considering purchasing expensive machinery to enhance production. If interest rates are low, borrowing for that purchase is more affordable, so the business may move forward with the investment. However, when interest rates spike, the cost of borrowing rises, making the same investment less attractive due to increased capital costs.

The relationship between interest rates and capital costs can be captured by examining the cost of capital—a key metric reflecting the expenses of financing investments, whether through debt or equity. Higher interest rates increase the cost of debt, and this often leads companies to delay or cancel projects that may not yield sufficient returns.

The Influence of Monetary Policy

Monetary policy decisions by central banks, such as raising or lowering benchmark interest rates, have significant ripple effects on business capital costs. When central banks increase rates to curb inflation, borrowing costs rise for companies across the board. This typically constrains business expansion as firms grapple with higher financing expenses.

Conversely, during periods of economic slowdown, central banks often lower interest rates to stimulate borrowing and investment. Reduced capital costs encourage businesses to initiate new projects, hire more staff, and innovate.

Breaking Down the Components: Debt vs. Equity Capital Costs

Capital costs are not just tied to interest rates on loans; companies also raise capital through equity—selling shares to investors. Debt and equity each have different cost structures, and interest rates primarily affect the debt portion.

| Capital Type | Cost Basis | Effect of Interest Rates | Impact on Business |

|---|---|---|---|

| Debt Capital | Interest payments on borrowed funds | Directly impacted; higher rates increase cost | Higher financing expenses, can reduce investment |

| Equity Capital | Dividends and shareholder expectations | Indirectly influenced; higher rates can raise expected returns | May increase required returns, affecting valuation |

Higher interest rates mean debt becomes more expensive, making debt financing less attractive relative to equity. However, investors often expect higher returns when interest rates rise, thereby increasing the cost of equity capital as well.

Cost of Capital and Project Evaluation

Businesses evaluate potential projects by comparing expected returns to the cost of capital. When interest rates elevate capital costs, a project’s hurdle rate—the minimum acceptable return—goes up. This means fewer projects will meet financial criteria, potentially slowing growth and innovation.

Real-World Examples Illustrating the Impact

Consider a manufacturing company looking to expand its operations by building a new facility. Suppose the prevailing interest rate is around 3%, and the company secures a loan for $10 million. The annual interest expense would be $300,000, which may be manageable given expected revenues.

Now, if interest rates rise to 7%, the annual interest expense jumps to $700,000—more than doubling. This sharp rise in capital costs could lead the company to reconsider or delay the project. Such changes in decisions are common across industries whenever interest rates fluctuate significantly.

Interest Rates and Capital Costs in Different Economic Cycles

The economic environment heavily influences interest rates and, by extension, capital costs. During booming economies, central banks might raise rates to prevent overheating, increasing the cost of capital. In recessions, the opposite occurs leading to cheaper borrowing.

Businesses need to adapt strategies accordingly:

- High-Interest Rate Periods: Focus on cost control, minimize debt, prioritize high-return projects.

- Low-Interest Rate Periods: Leverage cheaper financing, pursue growth initiatives, invest in innovation.

Understanding these patterns can help companies manage capital structure and investment planning more effectively.

Strategies Businesses Can Use to Manage Capital Costs Amid Interest Rate Changes

Navigating changing interest rates requires proactive management. Here are some strategies companies use:

- Fixed-Rate Borrowing: Locking in loans at a fixed interest rate to avoid rising costs if rates increase.

- Refinancing: Replacing existing high-interest debt with cheaper options when rates decline.

- Capital Structure Optimization: Balancing debt and equity to minimize overall capital costs.

- Hedging: Using financial instruments like interest rate swaps to mitigate exposure to variable rates.

- Project Prioritization: Investing in projects with higher returns that can withstand increased capital costs.

Each approach has trade-offs, and the right strategy depends on factors like company size, industry, and growth ambitions.

The Role of Inflation and Inflation Expectations

Interest rates often rise alongside inflation, as lenders demand higher compensation to offset the decreased purchasing power of future payments. Inflation affects capital costs not only through increasing interest rates but also by driving up the price of assets and inputs.

When inflation expectations rise, financial markets anticipate higher future interest rates, which can immediately push up borrowing costs. This compound effect means companies need to carefully monitor both inflation and interest rate trends to accurately assess their capital costs.

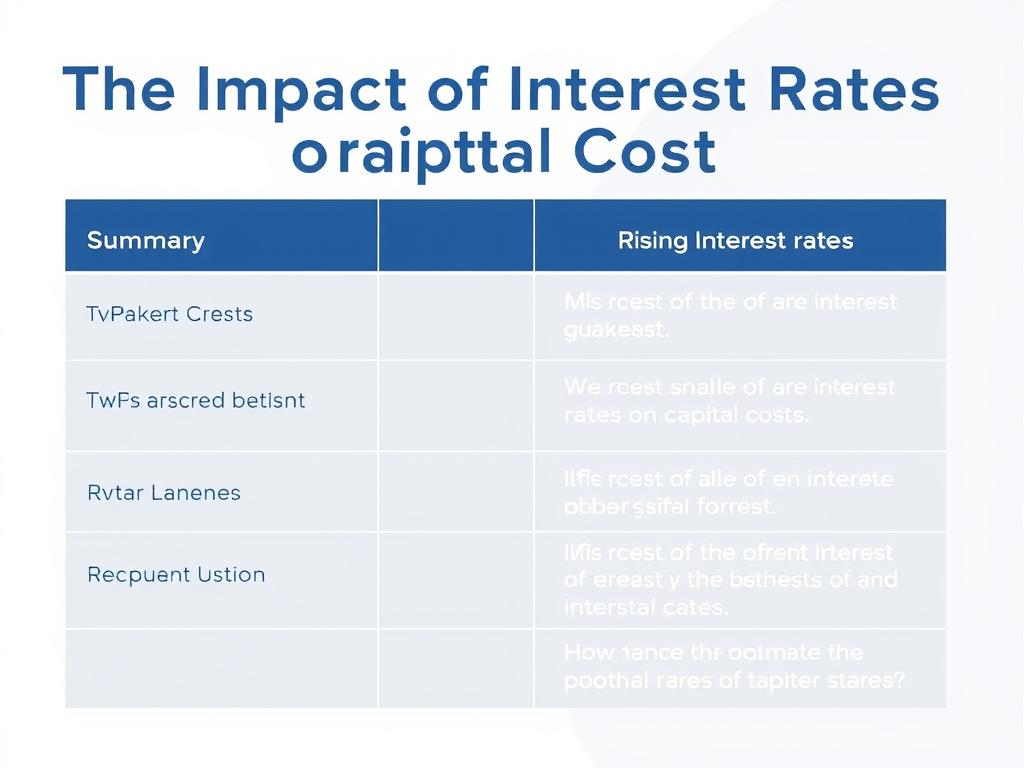

Summary Table: Key Effects of Rising Interest Rates on Capital Costs

| Effect | Description | Business Impact |

|---|---|---|

| Higher Borrowing Costs | Interest expenses increase on new and variable-rate loans | Increased cash outflows, reduced profitability |

| Increased Cost of Equity | Investor required returns rise with higher rates | Raises hurdle rates, limits project approvals |

| Reduced Investment | Projects become less financially viable | Slower growth and innovation |

| Balance Sheet Pressure | Higher debt costs can strain finances | Risk of credit downgrades or liquidity issues |

Final Thoughts: Staying Ahead of Interest Rate Changes

Businesses operate in dynamic financial environments where interest rates and capital costs are closely intertwined. Companies that understand how interest rates impact their capital costs can make smarter borrowing decisions, optimize investments, and navigate economic cycles more effectively.

Being proactive—through strategic financing, efficient capital management, and keen market awareness—empowers businesses to mitigate risks and seize opportunities that fluctuating interest rates inevitably present.

Conclusion

In summary, the impact of interest rates on capital costs is profound and multifaceted. Interest rates determine how expensive it is for businesses to borrow, directly influencing their capital expenses and investment decisions. Higher interest rates raise the cost of both debt and equity financing, leading to stricter project evaluations and often slower growth. Conversely, lower rates encourage borrowing and expansion. Companies that grasp this relationship can better manage their financial strategies, employ effective tactics to mitigate risks from interest rate fluctuations, and ultimately strengthen their competitive position. Navigating the ever-changing landscape of interest rates with insight and agility is essential for sustainable business success.